If you’re an employer or accountant operating in Italy, one bureaucratic phrase recurs month after month: “denuncia mensile analitica.” Often abbreviated as DMA, this term is far more than just paperwork—it is a legal obligation and a vital instrument in the country’s social security and employment monitoring ecosystem. But what exactly does it entail? Why is it necessary? And how has it evolved over the years?

In the first 100 words, let’s be clear: the denuncia mensile analitica is a monthly analytical report submitted by employers to INPS (Istituto Nazionale della Previdenza Sociale), the Italian National Social Security Institute. This report captures detailed employee information, contributions, and wage-related data, enabling the public administration to calculate pensions, insurance, and benefits in an automated, traceable manner.

Now, let’s go deeper.

1. The Origins and Evolution of the Denuncia Mensile Analitica

1.1. From Manual Slips to Digital Uniformity

Prior to the digitalization of Italy’s public administration, reporting employment data to INPS was fragmented, manual, and often riddled with inconsistencies. The DMA system was introduced to resolve this inefficiency by centralizing and standardizing how employee data was communicated.

Initially part of the broader UniEmens project launched in 2010, the DMA is essentially the heartbeat of this digital architecture. It allowed the transition from multiple declarations to a unified electronic system where all data is now transmitted in XML format.

2. What Exactly Is the Denuncia Mensile Analitica?

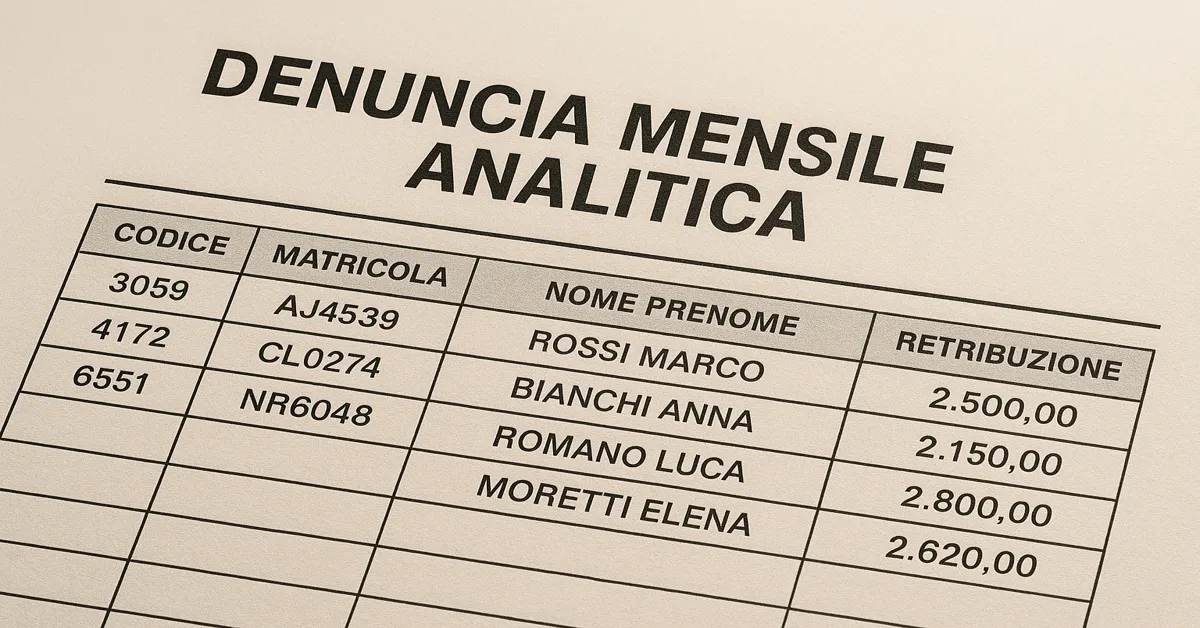

The DMA is a mandatory monthly submission that includes highly detailed records for each employee. It includes:

- Personal identification details (name, tax code, social security number)

- Employment type and contract details

- Gross salary

- Hours worked

- Contributions owed to INPS

- Withholdings (pension, maternity, unemployment, etc.)

- Absence days (sick leave, maternity, etc.)

- Other indemnities or adjustments

Each element is structured in a data field within the XML file and must comply with strict formatting rules issued by INPS.

3. Why the DMA Matters: Legal and Financial Implications

The importance of the denuncia mensile analitica can’t be overstated. It is legally binding, and errors or omissions can trigger fines, audits, and even criminal liability in cases of intentional fraud.

It serves as:

- The basis for calculating employee social security benefits

- A compliance indicator for labor inspections

- A source of statistical labor data at national and EU levels

- A historical record for pension accumulation and insurance coverage

Failure to submit the DMA accurately or on time disrupts not just government systems, but the personal entitlements of workers.

4. Who Is Required to Submit It?

Any employer registered with INPS—whether a private company, public entity, or non-profit—is required to submit the DMA. This includes:

- Large corporations

- Small and medium enterprises (SMEs)

- Cooperatives

- Family businesses with registered employees

- Public administrations with payroll obligations

Even foreign companies operating in Italy must comply if they employ workers under Italian labor contracts.

5. How the Submission Process Works

5.1. Payroll Software and INPS Portals

Most companies use certified payroll software capable of generating the XML files in accordance with INPS specifications. Once generated, the file is transmitted via:

- INPS “Cassetto Previdenziale” portal

- Intermediaries (like accountants or labor consultants) using authorized channels

After submission, the system issues a receipt and protocol number, confirming compliance.

5.2. Deadlines

DMA submissions are generally due by the end of the month following the reference month. For example, the declaration for January must be submitted by the end of February.

Late submissions incur administrative penalties based on number of employees and delay duration.

6. The Data Structure: A Glimpse Inside the XML

For those unfamiliar with the back end, the structure of a DMA file might seem intimidating. However, it’s built around modular data blocks, including:

- <Azienda>: Employer details

- <Dipendente>: Employee profiles

- <Retribuzioni>: Salaries and wages

- <Contributi>: Contributions breakdown

- <Eventi>: Events such as illness, injury, parental leave

Each of these modules must follow syntactic validation rules. If a single comma or code is misplaced, the system may reject the entire file.

7. Common Mistakes and How to Avoid Them

Here are some pitfalls that employers often encounter:

- Wrong contribution codes for contract types

- Duplicate entries for the same employee

- Incorrect classification of leave

- Failure to update changes in contract terms

Avoiding these issues requires continuous training, software updates, and coordination with certified labor consultants (consulenti del lavoro).

8. How DMA Interacts with Other Systems

8.1. UniEmens and DMA: Two Sides of the Same Coin

DMA is one half of the broader UniEmens declaration, which also includes the Denuncia Aziendale Mensile (DAM)—the part that outlines general company data.

Together, these create a unified database from which INPS draws individual and aggregate insights.

8.2. Integration with Agenzia delle Entrate and INAIL

Through data cross-verification, the DMA interacts with:

- The tax authority (Agenzia delle Entrate) for income and withholding matching

- INAIL for workplace accident coverage

- ISTAT for labor market analysis

9. What’s New in 2025: Updates to DMA Reporting

As of 2025, several updates are rolling out to modernize and align Italy’s DMA system with European Social Security Digitalization Initiatives.

Key changes include:

- More granular event reporting (hourly-level time tracking for flexible workers)

- New contribution codes for emerging contract types (like remote-first agreements)

- Automatic pre-validation tools to assist in real-time error detection

These changes aim to improve transparency, reduce fraud, and streamline benefits processing.

10. Special Considerations for Particular Categories

10.1. Domestic Workers

Employers of domestic workers submit a simplified version of the DMA, typically via the INPS Domestic Work portal. It includes basic hours and wages but still plays a key role in social security rights.

10.2. Temporary and Seasonal Contracts

For agricultural or tourism sectors, additional modules exist to account for seasonal variation, rotating shifts, and contract expiration nuances.

11. The Human Side: Why This Matters to Workers

While DMA may appear bureaucratic, it directly affects people’s lives. Every pension contribution, parental leave, and unemployment benefit is traceable to these monthly declarations.

When mistakes are made:

- A retired worker’s pension may be calculated incorrectly

- A new mother’s leave may be delayed

- A laid-off employee’s unemployment benefit may be suspended

Thus, the accuracy of the DMA is not just an administrative detail—it is an act of social responsibility.

12. Digital Challenges and the Road Ahead

Despite automation, challenges persist:

- Software mismatches

- Small business underreporting

- Delays in data reconciliation

To address these, Italy is exploring:

- Blockchain-backed labor records

- AI-based fraud detection systems

- Integrated labor/tax reporting platforms

Such innovations may soon make the monthly declaration a seamless, real-time process, reducing burden while improving integrity.

Conclusion: More Than a Report—A Pillar of the Welfare State

The denuncia mensile analitica is not just a regulatory form. It is the connective tissue between employers, employees, and the public systems that sustain Italy’s welfare state. Its accuracy ensures fairness. Its timeliness guarantees continuity. And its evolution reflects the country’s broader journey toward digital governance and labor equity.

For employers, it is a duty.

For consultants, it is a craft.

And for employees, it is a quiet assurance that their work counts—and will be counted.

FAQs

1. What is the “denuncia mensile analitica”?

The denuncia mensile analitica (DMA) is a mandatory monthly report submitted by Italian employers to INPS. It details each employee’s wages, hours, contributions, absences, and employment status. This data is crucial for calculating social security, pensions, and other labor-related benefits.

2. Who is required to submit the DMA?

All employers registered with INPS—including businesses, public administrations, and non-profits—must submit a DMA every month if they have employees on payroll, including part-time, seasonal, or temporary workers.

3. What happens if the DMA is submitted late or contains errors?

Late or incorrect submissions can lead to administrative fines, delays in employee benefit processing, and possible audits by labor inspectors. Errors in contribution data may also impact employees’ future pension or insurance entitlements.

4. How is the DMA submitted to INPS?

The DMA is submitted electronically through the INPS portal or via certified intermediaries using payroll software that generates the XML file in the required format. A submission receipt confirms compliance.

5. What’s new in DMA reporting for 2025?

As of 2025, DMA reporting includes hourly tracking for flexible contracts, new codes for remote-first jobs, and pre-validation tools that help detect errors before final submission, improving compliance and accuracy.